💡 Introduction

Applying for a PAN card at home is easier than ever before. No more standing in long queues or wasting an entire day just to submit a form. With digital India initiatives, the entire process is now online — fast, safe, and super convenient.

If you’re wondering how to apply for a PAN card from the comfort of your couch, this article is your complete guide. Let’s break it down!

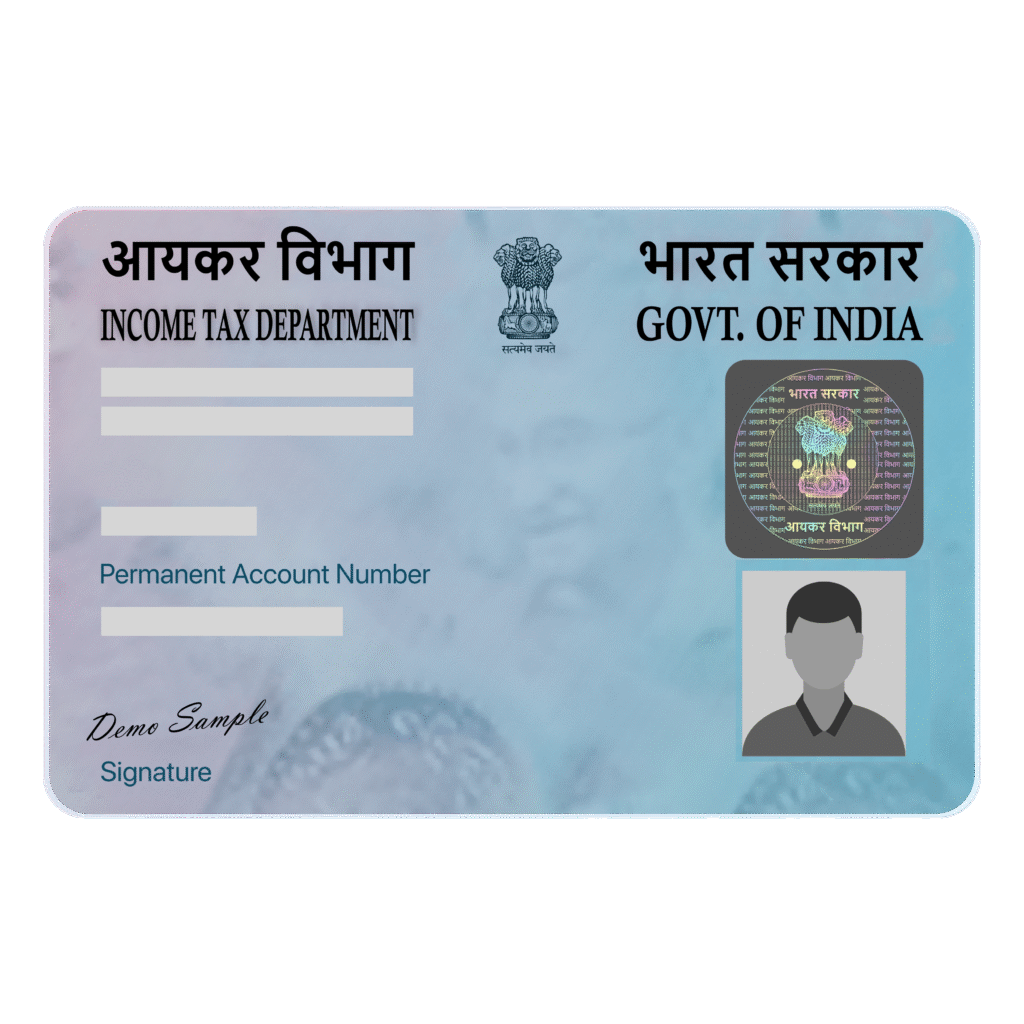

🔍 What is a PAN Card?

PAN stands for Permanent Account Number, a 10 digit alphabet and Numberic code issued by the Income Tax Department of India. It’s essential for:

- Filing income tax returns

- Opening a bank account

- Conducting high-value transactions

- Applying for loans or credit cards

- Buying/selling property or vehicles

Who Needs a PAN Card?

- Indian citizens earning taxable income

- Students above 18 for financial transactions

- Businesses and freelancers

- NRIs with financial interests in India

📂 Types of PAN Card Applications

1. New PAN Card

If you don’t have a PAN yet, this is your category.

2. Correction/Update

Have a typo in your PAN? Need to change your name after marriage? Apply for a correction or update.

3. Reprint PAN

Lost your PAN card? No worries. Just apply for a reprint. PAN number stays the same.

📑 Documents Required for PAN Card Application

Here’s what you need:

✅ Proof of Identity (Any one)

- Aadhaar Card

- Voter ID

- Driving License

- Passport

✅ Proof of Address (Any one)

- Electricity/Water Bill

- Bank Statement

- Aadhaar Card (if address is updated)

✅ Proof of Date of Birth

- Birth Certificate

- Matriculation Certificate

- Passport

✅ Passport-Size Photograph

- For physical documents or scanned uploads

🌐 Platforms to Apply for PAN Card Online

1. NSDL (Now Protean eGov Technologies)

2. UTIITSL

Both are authorized by the Income Tax Department to process PAN applications.

🧭 How to Apply for PAN Card via NSDL (Protean)

📝 Step 1: Visit NSDL PAN Application Page

Go to: https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html

📝 Step 2: Select Application Type

Choose:

- New PAN – Indian Citizen (Form 49A) for most cases.

📝 Step 3: Fill in Your Details

Enter:

- Full Name

- Date of Birth

- Mobile Number

- Email ID

- Aadhaar Number (if using e-KYC)

📝 Step 4: Choose Submission Method

Options:

- e-KYC (Aadhaar OTP)

- Upload scanned docs

- Send documents via post

📝 Step 5: Upload Documents (If Not Using e-KYC)

Scan and upload:

- Photo

- Signature

- Identity & Address Proof

📝 Step 6: Make Payment

- ₹106 for Indian communication address

- ₹1,017 for foreign address

Pay via:

- Credit/Debit Card

- UPI

- Net Banking

📝 Step 7: Submit and Download Acknowledgment

After submission:

- Download and print acknowledgment

- Sign and post if required

📱 How to Apply via UTIITSL

Visit: https://www.pan.utiitsl.com/PAN/newA.html

Follow similar steps:

- Choose “Apply for New PAN”

- Fill form

- Upload documents

- Pay fees

- Submit and track

UTIITSL is considered slightly more user-friendly for beginners.

⚡ Aadhaar-Based Instant PAN Using e-KYC

If you have a valid Aadhaar, you can get your PAN instantly.

How it Works:

- No need to upload documents

- OTP sent to Aadhaar-linked mobile

- PAN generated instantly and downloadable in PDF format

Apply at: https://incometax.gov.in

💰 PAN Card Fees and Charges

| Application Type | Fee (INR) |

|---|---|

| Indian Address | ₹106 (incl. GST) |

| Foreign Address | ₹1,017 |

| Correction/Reprint | ₹50 – ₹106 |

📤 Modes of Document Submission

1. Aadhaar e-KYC

- Fastest and paperless

- OTP-based verification

2. Scanned Uploads

- Scan photo, signature, ID/address proof

3. Physical Post

- Required if e-KYC isn’t used

- Send acknowledgment + documents to NSDL/UTIITSL

📬 Track PAN Card Status

Track it online:

- NSDL: https://tin.tin.nsdl.com/pantan/StatusTrack.html

- UTIITSL: https://www.trackpan.utiitsl.com/PANONLINE/#forward

Or check via:

- Email/SMS using acknowledgment number

⏳ How Long Does It Take to Get PAN Card?

- e-PAN (Aadhaar-based): Within 10 minutes

- Physical PAN: 10–15 business days by post

🚫 Common Mistakes to Avoid

- Wrong spelling of name

- Date of birth mismatch

- Unclear document scans

- Signature outside box

- Incorrect Aadhaar number

Double-check everything before submitting!

🎯 Benefits of Applying PAN from Home

- No agent commission or hidden costs

- Easy UPI/net banking payments

- Track status anytime

- Get PAN instantly with Aadhaar

- Save time and energy

✅ Conclusion

Applying for a PAN card from home is no longer rocket science. With just a few clicks, your Permanent Account Number can be in your inbox (or mailbox) within days. Whether you’re a student, salaried professional, or a freelancer — having a PAN is a must in today’s digital economy. Don’t delay, apply today!

FAQ

Can I apply for a PAN card without Aadhaar?

Yes, you can use other identity and address proofs, but the process won’t be instant.

Is digital signature mandatory?

No. You can use Aadhaar OTP or upload scanned signatures instead.

How to get PAN card in PDF?

If you used Aadhaar OTP, you’ll receive a digitally signed e-PAN PDF via email.

Can I apply for PAN card on mobile?

Absolutely! All portals are mobile-friendly. You can apply using any smartphone.

What if I lose my PAN card?

Just apply for a reprint using your PAN number and Aadhaar. You’ll get a new physical card.