The rise of digital lending has made accessing quick loans easier than ever. However, this convenience has also given rise to a growing number of fraudulent loan applications that prey on vulnerable borrowers. These fake loan apps can lead to financial loss, data theft, harassment, and severe privacy violations. Here’s everything you need to know about identifying and protecting yourself from these predatory platforms.

1. Understanding the Problem

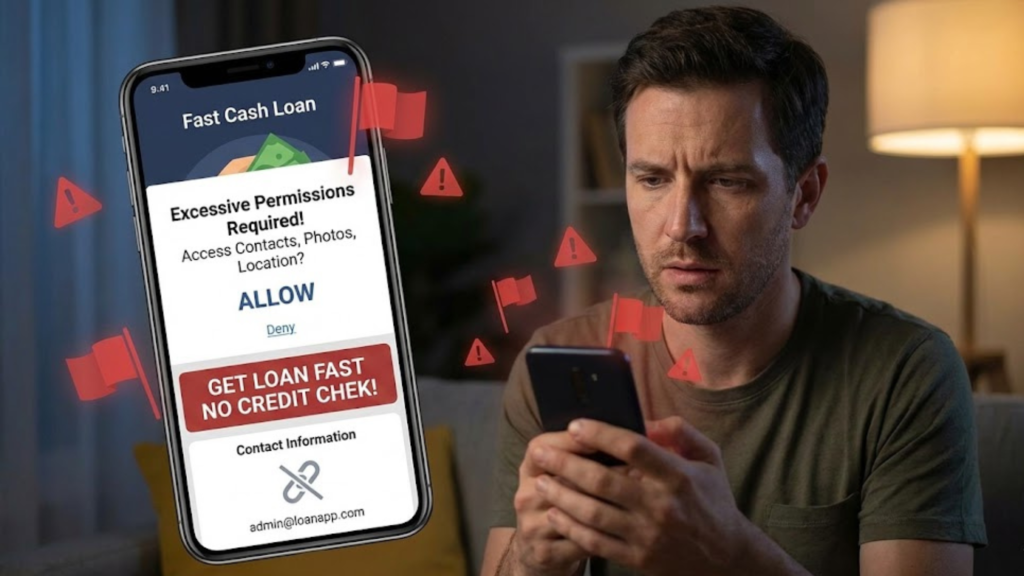

Fake loan apps typically disguise themselves as legitimate lending platforms, offering instant loans with minimal documentation. Once users download these apps and provide personal information, they often face unauthorized charges, data misuse, extortion, and aggressive harassment tactics.

2. Warning Signs of Fake Loan Apps

- Unrealistic Promises: Be wary of apps offering instant approval with no credit checks, extremely low interest rates, or guaranteed approval regardless of your financial history. Legitimate lenders always conduct proper verification.

- Excessive Permissions: Fake apps often request unnecessary access to your contacts, messages, photos, call logs, and other sensitive data that has nothing to do with loan processing.

- Poor App Quality: Look out for apps with unprofessional interfaces, grammatical errors, poor design quality, and limited or fake reviews on app stores.

- No Physical Address or Contact Information: Legitimate financial institutions always have verifiable office addresses, customer service numbers, and clear contact details. Fake apps often provide only email addresses or chat support.

- Upfront Fees: Be suspicious of apps demanding processing fees, registration charges, or advance payments before loan approval. Legitimate lenders deduct fees from the loan amount, not beforehand.

- Pressure Tactics: Fraudulent apps create urgency, pushing you to make quick decisions without proper consideration or research.

3. How to Protect Yourself

- Verify Registration and Licensing: Always check if the lending platform is registered with the appropriate financial regulatory authorities in your country. In India, for example, legitimate digital lenders should be registered with the Reserve Bank of India or operate through RBI-registered NBFCs.

- Research Thoroughly: Before downloading any loan app, research the company online. Look for their website, read independent reviews, check social media presence, and search for any complaints or scam reports.

- Check App Store Ratings Carefully: While ratings can be helpful, be aware that they can be manipulated. Read through negative reviews to understand common complaints. Check the developer information and look for apps from established financial institutions.

- Read the Fine Print: Always review the terms and conditions, privacy policy, and loan agreement carefully. Understand the interest rates, processing fees, repayment terms, and penalties before agreeing to anything.

- Protect Your Personal Information: Only share information that’s absolutely necessary for loan processing. Never share sensitive details like your full bank account passwords, debit/credit card PINs, or OTPs with anyone.

- Download from Official Sources: Only download apps from official app stores like Google Play Store or Apple App Store. Avoid downloading APK files from third-party websites.

- Monitor Permissions: Before installing, review what permissions the app is requesting. A loan app shouldn’t need access to your entire contact list, messages, or photo gallery.

- Use Strong Passwords: Create unique, strong passwords for loan apps and enable two-factor authentication wherever available.

4. What to Do If You’ve Been Scammed

If you’ve already fallen victim to a fake loan app, take immediate action. Report the incident to your local cybercrime cell or police department. File a complaint with financial regulatory authorities. If unauthorized transactions have occurred, immediately contact your bank to block your cards and accounts. Report the app to the app store for removal. Change all your passwords and monitor your bank statements closely for suspicious activity. Consider placing a fraud alert on your credit reports.

5. Safe Borrowing Practices

When you need a loan, prefer borrowing from established banks, credit unions, or well-known fintech companies with proven track records. Compare multiple legitimate options before making a decision. Understand the total cost of the loan, including all fees and charges. Borrow only what you need and can realistically repay. Keep all documentation and communication related to your loan for future reference.

6. Building Financial Awareness

Educate yourself about financial literacy and responsible borrowing. Stay updated about common scam tactics through financial awareness programs. Share information about fraudulent apps with friends and family to protect your community. If an offer seems too good to be true, it probably is.

The convenience of digital lending shouldn’t come at the cost of your financial security and privacy. By staying vigilant, doing your due diligence, and following these protective measures, you can safely navigate the digital lending landscape while avoiding the traps set by fraudulent loan apps. Remember, taking a little extra time to verify legitimacy is always worth the effort when it comes to protecting your financial wellbeing.